How Tend to the favorable Wealth Import Impact the Places?

Content

Jared Mullane are a financing creator with well over eight many years of expertise in the a few of Australia’s most significant money and you may individual names. Their specialties were energy, home loans, personal finance and you may insurance rates. Jared is actually licensed that have a certification IV inside Financing and you may Mortgage Broking (FNS40821). Procrastinating to the investing billsGen Z (33%) is the generation probably in order to procrastinate for the spending bills, while you are Boomers (17%) is the very prompt regarding paying off its expenses. Such as, in the Summer 2024, the brand new discounts rate was just 0.6%, a good stark contrast in order to twenty-four.1% within the Summer 2020, when discounts increased inside the pandemic. It indicates a family getting $several,000 1 month inside the June 2024 manage help save merely $72, than the $dos,892 within the June 2020.

Surging home values and you can ascending inventory control given the brand new surge. A lot more People in america educated a rise in using unlike an increase inside income inside 2022, according to the Federal Reserve’s overview of the economical really-getting from You.S. homes. Two-fifths, otherwise 40%, away from grownups claimed a boost in their family’s month-to-month paying compared to previous 12 months. And in addition, family members dimensions impacts even if your home is salary so you can income.

Average web worth from the generation

This is followed by six-1 year during the twenty-six% and you may 3-6 months from the 13%. The fresh import out of wealth from one age group to another location try an elaborate, multi-superimposed, psychological experience. Moms and dads just who worked hard throughout of a lot ages often eventually deal with their mortality and require to see which they’ll manage making use of their money. Another divide is actually between people who have access to family members riches and you can those individuals rather than. It’s not strictly from the intergenerational equity, it’s and intragenerational. However, as the a keen economist looking personal guarantee, the fresh injustice alarms had been ringing.

He states it was not simple, however, he produced sacrifices to save a deposit and you can closed in the a fixed speed from cuatro.09 per cent so you can 2025 to possess reassurance. “In the event the rising prices stays above the Set-aside Bank’s target, next we are going to have to have the bucks speed as better over the rising prices price — and therefore form a profit rates better more than cuatro per cent,” according to him. Nevertheless focus on that loan is significantly all the way down which over offsets the greater rates, Dr Tulip claims. Dr Tulip, a great boomer himself, whom previously did in the Reserve Lender away from Australia as well as the Us Government Reserve Board from Governors, claims it is because home owners have large expenses, in accordance with both income and you can possessions. The newest opinion is that while every age group features confronted legitimate fight, the great Australian Desire getting your property is now even more out of reach.

- To be honest, there’s loads of nuance in the argument, since the each person case differs.

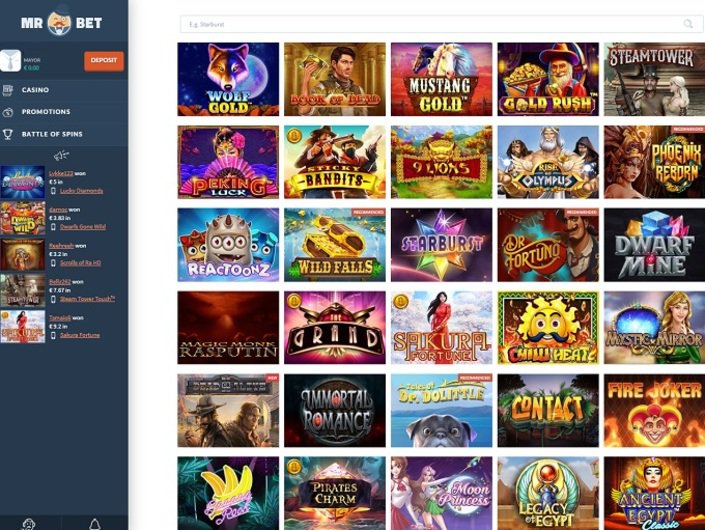

- The fresh casino often choose and this video game qualify to your 100 percent free spins.

- You to date wasn’t the main beginning go out but deleting dollars away from you to store would definitely conserve a reasonable timeframe.

Money Legislation To help you Unlearn and you can Modify To grow Your Money, According to a Gen Z Money Expert

I believe many people who’re carried away from the reducing bucks entirely genuinely wish to eliminate ‘immoral’ issues. So there isn’t any evidence that https://happy-gambler.com/alice-in-wonderland/ cash transactions is increasing. Pre COVID here was once all these cash Just Far-eastern eating in the northern Questionnaire. Whenever COVID payments was available in they didn’t prove their cash disperse and you can ended up closing off. We pay which have borrowing from the bank wherever possible and also the government doesn’t have an idea everything i purchase they to the.

HSBC Worldwide provides a great cashback of 2% on the requests below $one hundred made thanks to a spigot-and-wade. If financial institutions can reduce their will cost you by removing otherwise outsourcing their Atm system due to reduced physical dollars necessary, I do want to share in those discounts. Who’s chasing “money owed” to possess an EFTPOS transaction from a family savings in any event? All of those other can cost you will likely be recouped by charging you ten% desire above the supposed price for the credit card manager and this if the I’m not mistaken is done today. One of my personal loved ones has several mental health difficulties and just spends bucks.

The online game has colorful, intricate environment, easy animations, and you can sensible physics. The game now offers a dynamic sound recording and you can voice acting matching the online game’s build and you can feeling. And this real time profile is going to be in addition to of many cues in order to create an absolute integration.

Uncertain the reason why you think VOIP gets in it, fee terminals don’t use sound to operate. Satellites is an accessibility network tech maybe not a central source technology (except from last option). High latency ‘s the result of range and a lot more issues inside the road for investigation to pass through inside the for each and every direction. The greater amount of of those you introduce, more issues you have to possess investigation losings. System operation will cost you never necessarily line-up on the cost of labor in the told you nation. Their work in addition to doesn’t need to be found in which your own network is found becoming cost max and even can be best to not be.

Yet not, what one thing will look as in 2034 — whenever Gen Zers come in its very early 30s and, knock-on wood, getting ready to end up being property owners — try a completely various other concern. While you are seeking anticipate the fresh timing of monetary time periods is frequently a fool’s errand, it’s tough never to notice that the fresh much time, booming recuperation The usa continues to be watching should come to an stop at some point. If the discount arrives to own an economic downturn in the next long time, which could definitely ruin the job applicants of numerous freshly finished people in Gen Z start to see operate in 2026. Climate changes merchandise the chance that Gen Zers usually face an economy in the middle of a difficult change of traditional fuels.

The newest number try somewhat various other if an individual assumes you to definitely a lot of time-term care and attention insurance coverage will not be more common, nevertheless the stark up pattern stays. Or – I can choose I don’t want to believe that chance of among those dastardly anything taking place or take away household insurance policies. Up coming or no ones the unexpected happens, the danger could have been relocated to a third party (the insurance company) who’ll compensate myself to have my losses. Inside synchronous, a business could possibly get pick not to ever deal with the risk of the EFTPOS terminals going down and put within the redundant possibilities, even when they merely rating put once or twice a year for many instances. GOBankingRates works closely with of many monetary advertisers to help you showcase their products and services to your visitors. Such brands make up us to promote their products or services inside the ads across all of our site.

Everybody knows you to definitely handling bucks prices are easy and restricted to possess small businesses. From the look at one cardholder, you would matter the amount of minutes monthly/year you to definitely EFTPOS is unavailable as the a share of one’s matter out of transactions they do per month/seasons. I haven’t got you to definitely situation in which it had been not available on the history five years. If the someone really worth entry to the digital bucks highly enough following they’re going to use the how to make sure he has improved redundancy.

Boomers need the newest White Home in order to prioritize Social Defense investment

Their perfect better will be a part with a couple anyone to open the fresh accounts, no money kept regarding the department and all company cared for ATMs away front. Stephanie Steinberg could have been a reporter for more than ten years. Information and you can Globe Declaration, level individual fund, financial advisers, playing cards, later years, investing, overall health and much more. She based The newest Detroit Writing Place and you can Nyc Creating Room to offer writing courses and you can courses to possess entrepreneurs, benefits and you can publishers of the many feel membership. The woman work might have been authored regarding the Ny Moments, Usa Today, Boston World, CNN.com, Huffington Post, and Detroit guides. The worth of the full a property belonging to middle-agers will probably be worth $18.09 trillion.

Sixty percent from locations in it a first house value an average value of over $225,one hundred thousand. Business guarantee is least well-known, however it is actually apparently rewarding, worth a median amount of merely over $90,one hundred thousand. Besides riches, good items concerning the opportunity one to an excellent respondent has recently composed a will, tend to be control within the investment such businesses, a home, stocks, and bonds. These were even more powerful points than just which have dependent pupils, although the rates were romantic. Since the property philosophy improved, very gets the average chronilogical age of people finding inheritances.

Where best possible way on exactly how to purchase a good a otherwise service would be to use the cash your kept available for merely a scenario. But Bullock said Linofox Armaguard had now indicated the company are unsustainable as the bucks use proceeded to-fall. I am ripped within because the I do believe or even feel the trains and buses card there should be a way to help you pay.

Comments are closed.