What exactly is Possibilities Trading? A simple Evaluation

A margin membership is a type of broker membership where their broker gives your cash upfront, making use of your membership because the collateral, to buy bonds. Margin develops your own to buy energy, but inaddition it reveals one to higher exposure and you will possibly large loss. To higher understand the field of possibilities trade, there are plenty of information that will help educate hopeless buyers. The new SEC’s Workplace from Trader Knowledge have an excellent explainer to the options words you to definitely walks subscribers as a result of an example of a simple stock choice deal quotation.

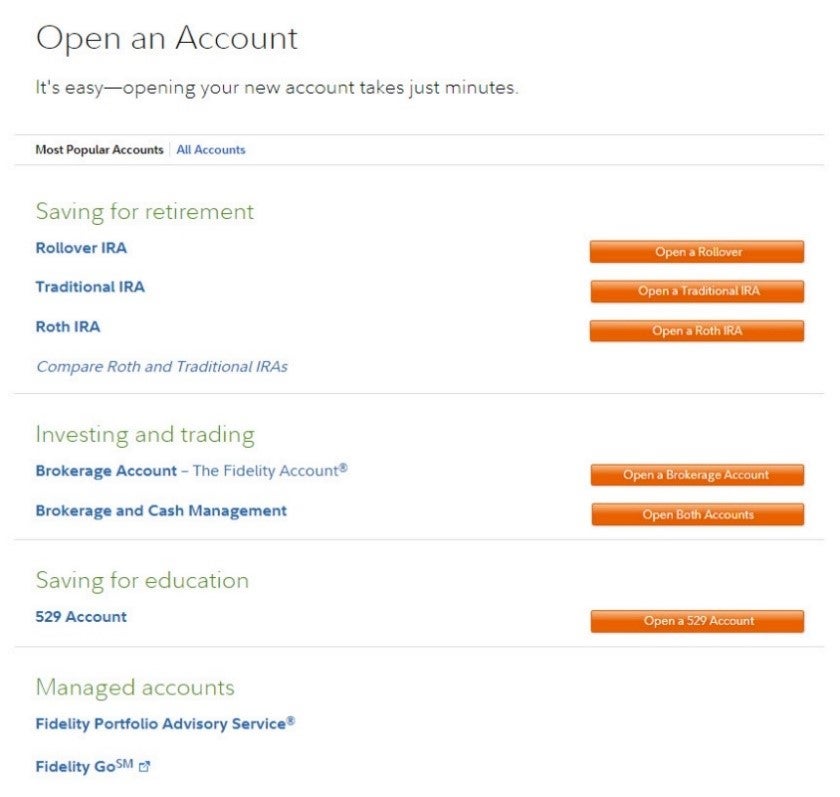

Far more profile

Basically, it is the rate where you should buy/offer offers out of stock for those who “exercise” your option. State you buy a https://www.ancoratours.com/blog/whats-cfd-trade-definition-threats-advantages-downsides/ call which have a strike cost of $105 and one day later on the new inventory jumps in order to $120. You’ll nevertheless be capable find the $120 stock during the strike cost of $105 because of the exercise the phone call option.

- Of numerous pros at the Maverick Trading add the fresh wheel for the wide earnings-dependent portfolios, precisely as it marries better having a clinical, rules-centered method.

- To discover the options that are available to possess a specific stock, attempt to make reference to a choice strings.

- Your own call alternative bargain makes you pick shares during the $50 for each.

- Therefore within this example, with a good $5 premium, the individuals Kale options create rates $five hundred per bargain.

- SoFi Dedicate is a wonderful platform for us traders that are searching for an user-friendly on the internet trading experience, an open energetic or automated spending membership.

- The newest exchange might possibly be effective if your resource rates increases a lot more than the fresh hit rates plus the superior your repaid.

Take note one results can vary with utilization of the tool through the years. For those who have a free account-particular concern or concern, please reach out to Buyer Features. Gold players earn 4.00% Annual Commission Give (APY) on the uninvested cash. Other common form of equity payment and are present, nevertheless these aren’t technically options. Create our very own weekly non-mundane newsletter regarding the currency, areas, and more. Roger Wohlner writes in the economic planning Wealthsimple.

Hence, it’s important to remember that your’re circuitously trade the root investment (such as a specific inventory) inside choices trading. As an alternative, you’lso are just exchange the fresh advantage to buy or sell you to definitely asset in the a selected price and you may day. One of many reasons to exchange options is always to hedge—otherwise manage—exposure. Traders just who individual positions within the holds could possibly get purchase put options to avoid losses.

Interactive Brokers Classification Cookie Policy

The utmost money ‘s the superior acquired when attempting to sell the option. A trader which offers a trip choice is bearish and you can thinks the underlying stock’s rate tend to fall or continue to be apparently near to the newest option’s strike price inside lifetime of the possibility. Gamma (Γ) is short for the rate of transform anywhere between an enthusiastic option’s delta and the fundamental asset’s rate. That is named 2nd-buy (second-derivative) price awareness. Gamma indicates the amount the newest delta perform changes given a good $1 relocate the underlying shelter. Let’s assume a trader is actually much time one phone call choice to your hypothetical inventory XYZ.

ETF trade prices will most likely not fundamentally echo the online investment well worth of your own hidden securities. A shared money/ETF prospectus contains it or any other advice and can be bought because of the chatting with Remark the characteristics and you will Dangers of Standardized Possibilities brochure before you start trade choices. Alternatives buyers could possibly get get rid of the entire level of the money otherwise far more within the a relatively short period of time.

The finest picks out of prompt also provides from your people

As the concepts are exactly the same except everything is flipped for the its head. I am trying to find buying the home since the I think the new value of our house tend to enjoy notably regarding the upcoming ages, but not, I’yards not ready to purchase it entirely right now. Ben is the previous Senior years and Spending Publisher to own Forbes Mentor. Agents fool around with trading acceptance profile to control the chance visibility away from the consumer and of the company itself.

By comparison, something whose value is not eroded by-time, such as an inventory, provides zero Theta. Alternatives spreads try steps that use some combinations of buying and you will promoting different choices for the wished exposure-come back character. Spreads is actually constructed having fun with vanilla extract options, and can take advantage of various scenarios such as large- or low-volatility environments, up- otherwise down-moves, otherwise something in the-between. They mix with an industry viewpoint (speculation) with limiting loss (hedging).

This may suggest being forced to pay a top speed to own an alternative than you might should. Additionally, it may suggest having difficulty trying to find consumers when you are to market, and having to decrease the price to do so. In some cases, you can be also compelled to support the deal in order to expiry and you will consume losing.

Options are and perhaps one of the most direct a method to dedicate inside oil. To own choices investors, an enthusiastic option’s everyday trade volume and discover desire will be the a couple of secret amounts to look at to make the most well-told financing behavior. These types of contracts include a buyer and you can seller, where buyer pays a premium for the legal rights provided because of the the newest offer. Label possibilities allow manager to shop for the brand new advantage in the a said speed inside a specific time period. Put choices, concurrently, allow the manager to offer the brand new asset at the a stated speed inside a certain time. For every phone call choice has a bullish client and you will a good bearish seller when you’re lay choices features a good bearish buyer and you can a bullish supplier.

For this reason, in the event the inventory XYZ expands or minimizes from the $1, the call option’s delta manage improve or disappear by 0.ten. Such as, suppose a trader sales an agreement with 100 name options for a stock you to’s already trade during the $ten. The new investor often recoup the woman will set you back when the inventory’s rates has reached $twelve. The brand new inherent really worth is the difference in the newest stock rates and you may the new preset strike speed to echo the newest option’s full success. Time worth represents the possibility that the new inventory price actions inside their prefer before their conclusion go out. Over the years, the time value decays, plus the choice will lose value for proprietors because it expires.

When do you get it done an alternative?

If the stock’s rate dropped as well as the alternative offer ended, you’d still be out the premium cost of $3 for every share. Your own name choice deal allows you to buy shares during the $fifty per. You could potentially effortlessly fool around with a call solution deal to purchase you to definitely stock for a cheap price, saving oneself $4,700 ($fifty x $a hundred, without any $3 for each express superior).

The aforementioned malfunction is strictly how options for the stocks work, but a call option are often used to get a hundred offers away from stock from the call’s struck speed, not one house. Since i have still have the choice inside my hands, I can take action the option and buy our house from the its hit price of $two hundred,000, to make a sweet funds of $140,100 along the way. Of a lot people favor brings over options, as they possibly can still build attractive production over the long term, without any danger of full loss to the options. In case your stock ends expiration during the $20 otherwise below, the choice have a tendency to expire meaningless, and also the investor seems to lose anything put into the fresh trading. On this page, we’ll talk about just how possibilities performs, the benefits and you can dangers of possibilities and the ways to initiate change options.

Comments are closed.